When people talk about “wealth,” they usually mean savings accounts, investments, and paid-off homes. But for most families in the Pickens County area, the conversation starts and ends with housing costs. Without stable, affordable housing, there’s little chance to build wealth at all.

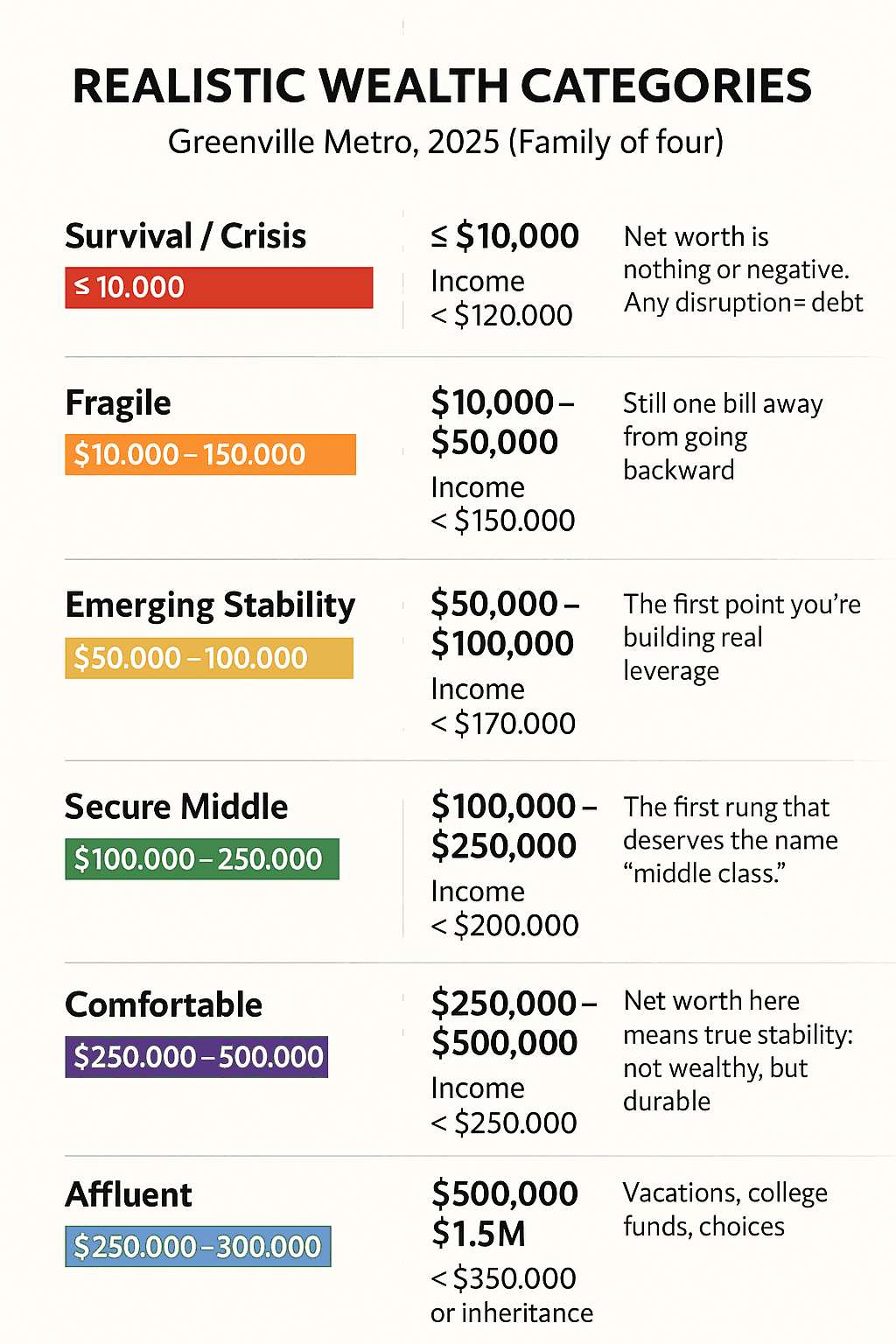

A recent MarketWatch article on wealth building breaks the U.S. into broad wealth classes: the “bottom 50%,” the “next 40%,” the “9%,” and the “top 1%.” That framing sounds neat on paper, but it hides how much more precarious things are in our neighborhoods. Local data show that nearly two-thirds of households fall into what MarketWatch would call the “bottom 50%.” That isn’t just inequality. It’s the normal condition for most families here.

The reason is simple math. In Pickens County, a family of four needs at least $120,000 to $150,000 a year to cover childcare, housing, transportation, healthcare, and groceries without going into debt. Here’s what that looks like on paper for a family earning $130,000 (about $8,600 take-home per month):

Housing (mortgage or rent): $2,200

Childcare (two kids): $2,000–$2,500

Healthcare (insurance + out-of-pocket): $1,200

Transportation: $1,000

Food and household basics: $1,200

Utilities and phones: $400

Other essentials (clothing, school, emergencies): $400–$600

That budget already adds up to $8,400–$9,100 per month, which means even a six-figure income leaves no breathing room. One unexpected bill, and the household is in the red.

Yet HUD’s 2025 income limits put “low income” for a family of four between $44,300 and $77,350. Families at that level are not building wealth. They are barely hanging on. At $70,000 a year, take-home pay lands closer to $4,600 per month, a figure that would not even cover rent, childcare, and healthcare combined.

That’s where Pickens County Habitat for Humanity changes the equation.

Habitat isn’t just about getting someone into a home. Our program is designed to unlock the one wealth-building tool that has always mattered most in America: homeownership. We make it possible by lending money without the massive down payments or high interest charges that block families out of the conventional mortgage market. Our families put in sweat equity, working alongside volunteers to build their own homes, and then pay a mortgage they can actually afford.

A Habitat mortgage is structured so that families paying rent (with no return) can redirect that same money toward equity. Instead of spending their entire paycheck on survival, families are able to fund the things that matter most, like preventative healthcare and education. They can set aside money for reliable transportation, for savings, and for the future. Those choices ripple forward, creating opportunities that were out of reach before.

And the impact doesn’t stop with individual families. Stable homeowners strengthen whole communities. When parents aren’t forced to move every year, schools see better student performance. When families build equity, neighborhoods see lower crime, higher civic participation, and stronger local economies. Habitat homes don’t just change lives. They change the trajectory of entire communities.

Habitat’s program isn’t charity. It gives families access to the financial stability ladder. Access to capital. By putting in the work and paying their mortgage, these families are able to begin building wealth that lasts for generations. And for Pickens County Habitat for Humanity families, that is often the very first chance to build any wealth at all.

Link to article: https://www.marketwatch.com/story/america-has-5-wealth-classes-see-where-you-fit-in-and-how-much-it-takes-to-reach-the-upper-echelons-25151801